A Primer: Reps and Warranties Insurance

By Matt Keefe,

Managing Director

Once a business owner has come to grips with selling his or her business, and once the buyer and seller have agreed to the key terms, then the legal documentation and closing phase of the M&A process begins. Inevitably, the documentation and closing phase can be frustrating and stressful for both the buyer and seller and can cause deals to stall, or sometimes even die. One aspect of documentation that usually creates issues is the negotiation of the escrow amount related to potential breaches of Representations and Warranties, or more often referred to as “Reps & Warranties” (Reps & Warranties is a term to describe the assertions that a seller makes to a buyer in a sale.) Fortunately, there is a burgeoning insurance product that is significantly alleviating the hassles tied to breaches of Reps & Warranties.

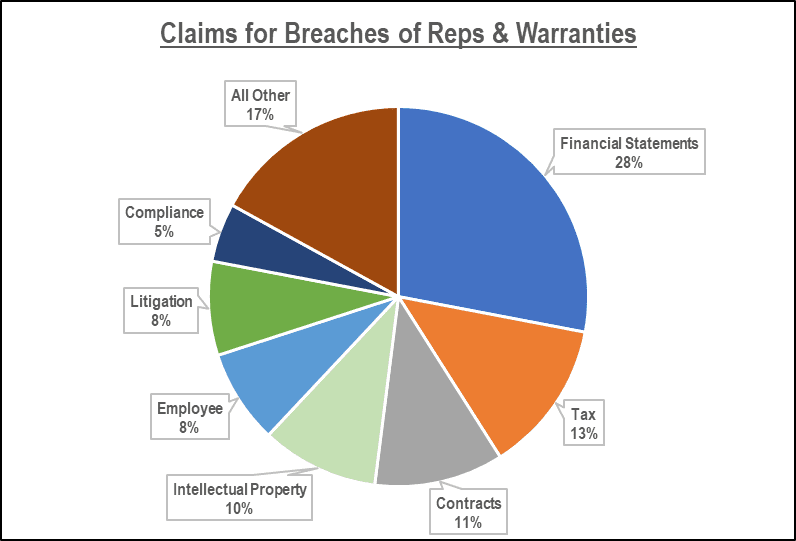

What are typical breaches that would cause a buyer to file a claim and seek compensation? Oswald Insurance, one of the nation’s largest independent insurance brokerage firms, conducted an analysis to identify Reps and Warranties claims by breach type. The results of that analysis are set forth below:

Before Reps & Warranties insurance was available, a buyer of a business would offset a portion of the potential risk related to breaches by asking the seller to hold-back, or escrow, a percentage of the total transaction value. This created a well-defined process whereby the buyer could file a claim against the escrowed amount to recoup a portion of the purchase price if a material breach was found. Typically, the escrow represented 5-10% of the total purchase price and was in place for six to eighteen months.

That was how it happened before Reps & Warranties Insurance came along. Now, Reps & Warranties Insurance is being used in lieu of the indemnity agreements that require escrowed funds. While Reps & Warranties Insurance is not a standard practice in all M&A transactions, the insurance product is being utilize more and more...for good reason.

Reps and Warranties Insurance provides benefits to both buyers and sellers. For buyers, as Chris Jones, Managing Director and Founder of Align Capital Partners, states, “Reps & Warranties Insurance allows us to provide more cash to the seller at closing (making our bid more attractive) and significantly increases the efficiency of legal documentation.” Other benefits to buyers include potential for protection beyond the traditional indemnity period, ability to reduce collection concerns, and the opportunity to augment fraud protection.

Sellers also enjoy significant benefits from Reps & Warranties Insurance. First, like buyers, sellers can reduce legal costs by eliminating the negotiations over post-closing indemnity obligations. Second, and most importantly to sellers, Reps and Warranties Insurance eliminates the need for an escrow, therefore, maximizing the cash proceeds to the seller at closing.

Like any insurance product, there is a cost (premium) for the insurance and that cost is tied to the amount of coverage. The amount of coverage is determined by the deductible limit. For example, in a $100 million transaction, a 10% deductible policy provides $10 million of coverage. The premium can be purchased by the seller and/or the buyer. Premiums are priced based on coverage and are typically 2%-4% of the transaction value. Therefore, the cost of the $10 million of coverage may be $200,000 - $400,000

Since the inception of the Reps & Warranties insurance product, the speed at which a policy can be issued has increased significantly. It typically takes two weeks for a policy to be underwritten. This has also expanded the popularity of the solution

As M&A Advisors, we are always looking for tools to help expedite the process. EdgePoint has closed several recent transactions that employed R&W insurance and found, in all case, the benefits (for all parties) outweighed the cost. To learn more about how EdgePoint uses Reps & Warranties Insurance, or to learn more about EdgePoint’s M&A capabilities, please contact us at 800-217-7139.

© Copyrighted by Matt Keefe, Managing Director of EdgePoint Capital Advisors, merger & acquisition advisors. Matt can be reached at 216-342-5863 or on the web at www.edgepoint.com.