Ownership Transition Advisory

EdgePoint provides a breadth of sell-side services designed to achieve a business owner’s custom tailored transaction objectives.

EdgePoint Takes a Relationship Based Approach

Experience Matters

Empathy Matters

Results Matter

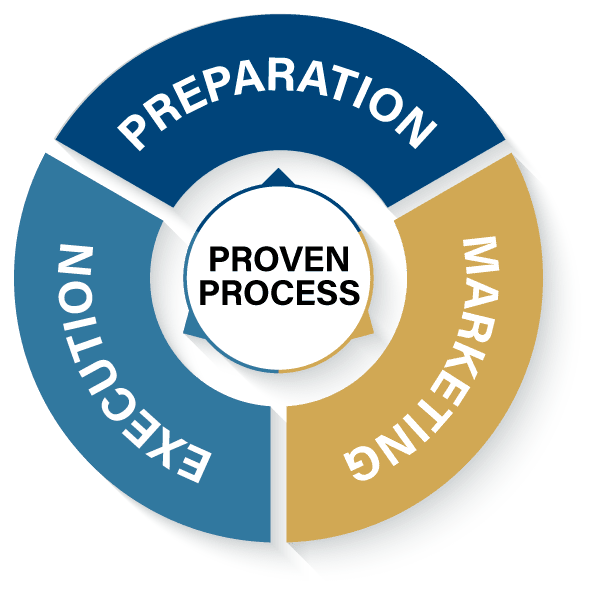

Custom process.

Disciplined execution.

EdgePoint has the ability to provide thoughtful ownership transaction advice that allows you to properly position your business to premium buyers. We leverage our knowledge and connections to make a market for your business and provide meaningful guidance throughout this process.

Our breadth of knowledge includes:

Majority Recapitalization

Corporate Divestiture

ESOP/Management Buyout

Joint Venture Partnership

The Seller Experience

White Paper Series

- Insights from EdgePoint-led survey of 150 business owners

- Practical advice on communicating with family and business leadership

Preparing the Owner for Transition

- Insights from EdgePoint-led survey of 150 business owners

- Practical advice on communicating with family and business leadership

Request a copy of “The Seller Experience: Preparing the Owner for Transition”

Why Owners Get Premium Values

- Insights from an EdgePoint-led survey of 200 serial buyers

- Leveraging an investment banker to tell your unique story and position your business

Why Owners Get Premium Values

- Insights from an EdgePoint-led survey of 200 serial buyers

- Leveraging an investment banker to tell your unique story and position your business

Request a copy of “The Seller Experience: Why Owners Get Premium Values”

Achieving dual goals of liquidity and growth

Our disciplined process and strategic counsel enabled this family-owned business to sell to an ideal financial partner while allowing the management team to continue serving customers.

Delivering Results with Integrity